Entertainment Tax is no longer applicable to music concerts in Gujarat

The Supreme Court waives off entertainment tax on musical events happening in Gujarat, be they for commercial or educational purposes.

The Supreme Court recently declared that musical programmes in Gujarat will not be liable to pay entertainment tax, even if a programme is being held for commercial and profit-generating purposes. The apex court contradicted the Gujarat High Court’s former understanding of Section 3A of the Gujarat Entertainments Tax Act, in the case Gypsy Pegasus Ltd. Vs. State of Gujarat.

A three-judge bench comprising Justice Ranjan Gogoi, Justice R Banumathi and Justice Navin Sinha supervised the proceedings. According to a TOI article, during an Arijit Singh concert on December 24, 2016, the organisers incurred a sum Rs 3.68 crore from ticket sales, against which they were liable to pay a tax amount of Rs 92 Lakh. The article states that ‘According to a government notification, 17% entertainment tax is levied for shows like these, based on the number of tickets sold.’ The organisers appealed to the court to waive this tax notice.

According to the High Court:

If a musical concert is organised in a “commercial manner and for profit making and which has no element of educational, medical, charitable, philanthropic or such other purposes, (they) are not entitled to exemption from payment of entertainment tax […].” The High Court refused to accept the petitioners’ claim that “for all the activities/entertainment mentioned in Schedule III irrespective of whether they are performed for any educational, medical, charitable, philanthropic or such other purposes or irrespective of fact whether they are performed for commercial purpose or not and/or there is a commercial element on such activities/entertainment, they shall be exempted from payment of entertainment tax […].”

The High Court then dismissed the Writ Petition.

According to the Apex Court:

However, the Supreme Court stated in its verdict that “The High Court could not have imposed the requirement of the entertainment to be for educational, cultural or charitable purpose when the form of entertainment in question is included in Schedule III to the Act.” The first item in Schedule III is “All kinds of musical programmes including musical nights and opera.”

The apex court then set aside the High Court order.

But hang on, there’s still the GST

Although this sounds like great news for musical event organisers, Anushree Rauta of IPRMENTLAW states that this decision by the Supreme Court might not make a big difference to organisers as the entertainment tax is now ‘subsumed under GST’. The organisers confirm that the government can procure 28% GST on all musical concerts. The only real beneficiaries would be entities who have pending cases and/or liability with entertainment tax department from dates before GST came into place.

promotional

Yatra Archives

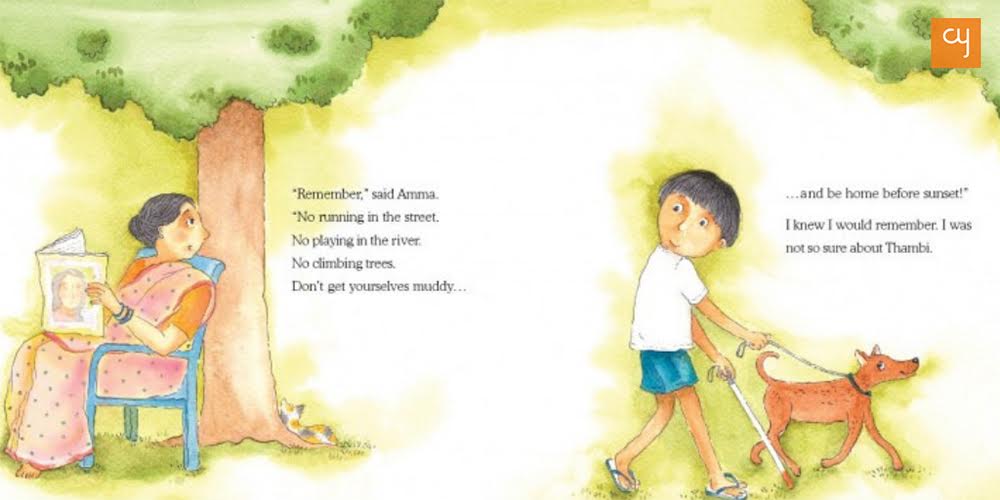

How Tulika Books is creating impact in children’s lives through picture books

Nandini Varma

How Tulika Books is creating impact in children’s lives through picture books

Nandini VarmaAug 21, 2019

A children’s book about a boy who feels like a girl. And about a child brought up by grandfathers. These are some of the stories published by Tulika Books, who have been making children’s picture books since 23 years. Little…

Dalgona Coffee: A worldwide social media trend about home-made café experience

Harshil Shah

Dalgona Coffee: A worldwide social media trend about home-made café experience

Harshil ShahApr 2, 2020

While the lockdown has ignited various trends on social media, one that has received a major global following is #DalgonaCoffee. With thousands of posts on its name, here’s all you need to know about the Dalgona Coffee wave. I first…

Leonardo, Michelangelo, Raphael and Donatello—Artists or Teenage Mutant Ninja Turtles characters?

Harshil Shah

Leonardo, Michelangelo, Raphael and Donatello—Artists or Teenage Mutant Ninja Turtles characters?

Harshil ShahNov 5, 2019

Did you ever wonder where the Teenage Mutant Ninja Turtles’ characters got their names from? Well, your search is complete. Here is a brief introduction of the artists from whom the creators of TMNT took inspiration. Teenage mutant ninja turtles,…

The call of the mountains: orthopaedic Dr Yatin Desai’s advice on trekking

Himanshu Nainani

The call of the mountains: orthopaedic Dr Yatin Desai’s advice on trekking

Himanshu NainaniMay 24, 2019

In this piece 64 year old Dr Yatin Desai, shares with CY his inspiring story of how to scale towering mountains with utmost ease and how this life adventure activity can shape human character and health. Chances are high that…